Denmark's oil and gas production has historically made a significant contribution to state revenue, Danish industrial development, and security of supply.

The North Sea Agreement of 2020 established a final end date for extraction, which will cease by 2050 at the latest.

Read the North Sea Agreement of 2020 (in Danish)

State Revenue and Sector Importance

Since production began in 1972, the Danish state has received substantial revenue from the North Sea. The revenue comes primarily from two sources: corporate tax (25%) and the special hydrocarbon tax (52%) on profits from extraction.

Additionally, the state receives income through the North Sea Fund's ownership share in the licenses.

Current figures for total revenue and production appear in the publication 'Economic Key Figures', available at the bottom of the page.

Sector Costs and Future Perspectives

Oil and gas extraction requires large, long-term investments. Historically, the majority of costs have been related to the exploration and development and operation of fields.

Towards 2050, the cost structure will change. As fields are depleted, expenses for decommissioning obsolete platforms and facilities will constitute a growing share. Simultaneously, possibilities are being explored for reusing parts of the existing infrastructure for new purposes, such as CO₂ capture and storage (CCS).

Rules for Hydrocarbon Taxation

The specific rules for the taxation of oil and gas extraction are laid out in the Hydrocarbon Tax Act.

An overview of the regulation can be found in the Ministry of Finance's 2017 publication: Current rules for hydrocarbon taxation (in Danish)

The Role of the Danish Energy Agency

The Danish Energy Agency supervises companies’ compliance with legislation and the conditions of their permits. This takes place, among other things, within the framework of the overall objectives of the Subsoil Act concerning the appropriate use of the subsoil and its resources.

This includes supervision to ensure that licence holders have the necessary financial capacity to cover the costs of establishment, operation, and the subsequent decommissioning of facilities.

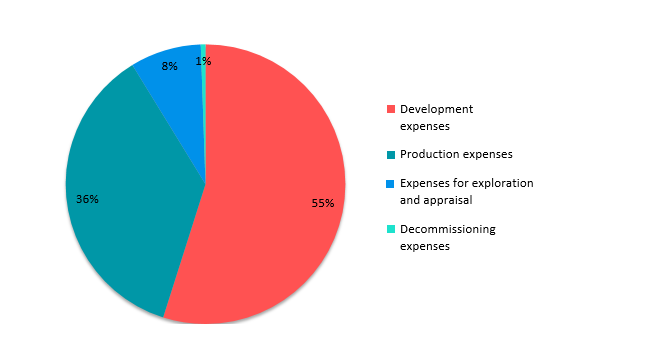

Distribution of licensees’ expenses (1972-2020)

The figure shows the distribution of expenses as follows:

- Development expenses: 55%

- Production expenses: 36%

- Expenses for exploration and appraisal: 8%

- Decommissioning expenses: 1%