Øget deponering og beskedent fald i affaldsforbrænding

Sammenlignet med 2020 bød år 2021 på mere deponering og en anelse mindre affaldsforbrænding. Det fremgår af rapporterne om benchmarking af de danske affaldsforbrændings- og deponeringsanlæg (BEATE) for dataåret 2021, som netop er offentliggjorte på Energistyrelsens hjemmeside.

Billede: Colourbox

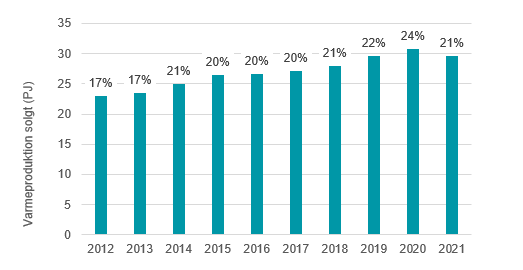

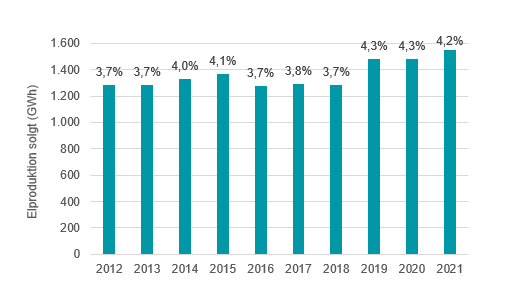

På trods af et beskedent fald i affaldsforbrændingen bidrager de danske affaldsforbrændingsanlæg fortsat til cirka en femtedel af fjernvarmeforsyningen og 4,2 procent af elforsyningen i Danmark (se figur 1 nederst i nyheden).

Det viser seneste benchmarking, som er udarbejdet med baggrund i den politiske aftale om ny organisering af affaldssektoren fra 2007. Formålet med benchmarkingen er at vurdere branchens økonomiske effektivitet samt miljø- og energieffektivitet på affaldsområdet.

Små fald i affaldsmængderne til forbrænding

Benchmarking af forbrændingssektoren indeholder data fra i alt 26 anlæg, herunder 19 dedikerede affaldsforbrændingsanlæg, fire multifyrede anlæg samt fire specialanlæg. På de 23 dedikerede og multifyrede anlæg faldt mængden af affald til forbrænding fra 2020 til 2021 med ca. tre procent svarende til 109.000 ton, hvilket primært skyldes et fald i forbrænding af dansk affald på ca. 88.000 tons, mens importeret affald faldt med ca. 21.000 tons. Set over en 10-årig periode fra 2012 til 2021 er affaldsmængderne i dedikerede og multifyrede anlæg steget med ca. 280.000 ton. Udviklingen er i perioden drevet af stigende mængder importeret affald til forbrænding, der i 2021 lå på 343.000 ton.

Benchmarking af deponeringssektoren indeholder data fra 40 anlæg. Resultaterne viser, at de samlede mængder affald til deponering, eksklusiv jord, har været faldende i perioden 2012-2020, mens de er steget i 2021 med ca. 27 procent. Årsagen er dels tilføjelsen af tre nye anlæg i BEATE 2021 samt øgede mængder på de resterende 37 anlæg. Kigges der isoleret set på de anlæg, som indgik i BEATE 2020, er mængderne steget med ca. 11 procent fra 2020 til 2021.

Læs BEATE fra 2021 og de forrige år

Gas udnyttet til energiproduktion

På deponeringsanlæg kan der ved nedbrydning af deponeret organisk affald dannes metan, som er en kraftig drivhusgas. I dag findes der forskellige metoder til at reducere metanudledningerne på blandt andet ved at indvinde gassen og udnytte den til energiformål. Benchmarkingen viser, at ni aktive deponeringsanlæg udnyttede den opsamlede gas til energiproduktion, hvilket i 2021 svarede til ca. 2,4 millioner m3. I perioden 2012 til 2021 har den samlede mængde opsamlet gas svinget mellem ca. 2 til 4,5 millioner m3 med sit højeste niveau i 2012.

En anden metode til at reducere udledningerne af drivhusgasser er ved hjælp af et såkaldt biocover. Et biocover er et metanoxiderende lag bestående af jord, kompost og lignende, der lægges oven på deponiet, hvormed mikroorganismerne omsætter metanudledningerne til CO2. Her har syv anlæg oplyst, at de har eller forventer at etablere et biocover senest i 2022.

Benchmarking af deponeringsanlæg overgår til Forsyningstilsynet

Det er 12. år, der foretages en obligatorisk benchmarking af økonomien og miljøforholdene på affaldsforbrændings- og deponeringsanlæg, og sidste gang med Energistyrelsen som udgiver. Som følge af Lov nr. 745 af 13. juni 2023 om Ny organisering af affaldsforbrændingssektoren og konkurrenceudsættelse af forbrændingsegnet affald, der trådte i kraft 1. juli 2023, skal benchmarking af deponeringsanlæg fremover overgå til Forsyningstilsynet som et led i Forsyningstilsynets øvrige økonomiske tilsyn med affaldssektoren. Benchmarking af affaldsforbrændingsanlæggene ophører derimod, eftersom anlæggene skal selskabsgøres og konkurrere om affaldet.

Note 1: Anlæggenes andel af den samlede indenlandske el- og varmeforsyning er opgjort på baggrund af anlæggenes indrapporterede solgte mængder af hhv. el og varme til BEATE, sammenholdt med den samlede indenlandske el- og varmeforsyning af hhv. el og varme i de respektive år.

Note 2: Den samlede indenlandske el- og varmeforsyning stammer fra baggrundsdata fra Energistyrelsens årlige energistatistik (link: https://ens.dk/service/statistik-data-noegletal-og-kort/maanedlig-og-aarlig-energistatistik).

Note 3: Siden BEATE 2020 er der anvendt et andet beregningsgrundlag end de tidligere år. Den årlige solgte el- og varmeproduktion er i 2020, og de øvrige historiske år i figuren, sammenlignet med den totale indenlandske forsyning af el og varme. Denne statistik ekskluderer derfor distributions- og transmissionstab samt graddage korrektion sammenlignet med tidligere års rapporter, hvor den solgte el- og varmeproduktion blev sammenlignet med endeligt energiforbrug. Den nye metode er anvendt på alle historiske år i figuren.