Oil and gas production from the Danish part of the North Sea is of great socio-economic significance. Danish society benefits from the tax revenue deriving from North Sea oil and gas production. Danish oil and gas production also contributes positively to Denmark’s balance of payments and trade.

In addition, the Danish society benefits from workplaces generated by the oil and gas sector, both on- and offshore. These jobs have part in creating purchasing power in the Danish society.

State revenue

The state generates revenue from North Sea activities primarily through taxation and dividends from Nordsøfonden.

The tax revenue from North Sea activities derive from hydrocarbon tax (52 pct.) and corporate income tax (25 pct.).

In addition, the Danish state receives revenue from North Sea activities through Nordsøfonden, which, since 2005, has managed the state’s 20 per cent share of all new licenses. Since 9 July 2012, Nordsøfonden has also managed the state’s 20 per cent share of Dansk Undergrunds Consortium (DUC), whose other partners are TotalEnergies and Noreco.

The total aggregate state revenues from hydrocarbon production in the North Sea in the period 1972-2020 amounted to approx. 544 bn. DKK (discounted by GDP-deflator in 2020-level). The total revenue from 2020 amounted to 0,8 bn. DKK.

Investments and expenses

Oil and gas production requires large, long-term investments. Through more than 50 years oil companies, with license in the North Sea, have invested heavily in exploration, development and operation of the Danish oil fields.

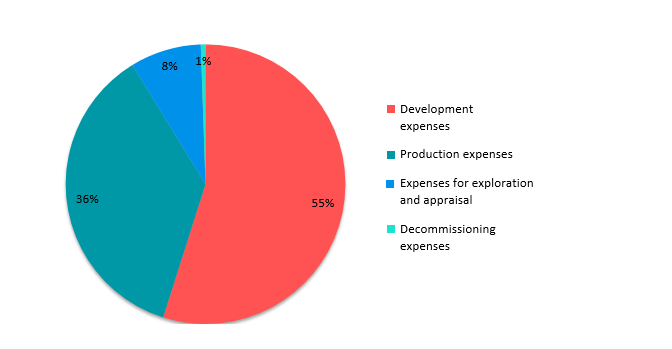

The distribution of the licensees’ expenditures for exploration, field developments and operations between the years 1972-2020 can be seen in the figure below.

Distribution of licensees’ expenses (1972-2020)

The figure shows the distribution of expenses as follows:

- Development expenses: 55%

- Production expenses: 36%

- Expenses for exploration and appraisal: 8%

- Decommissioning expenses: 1%